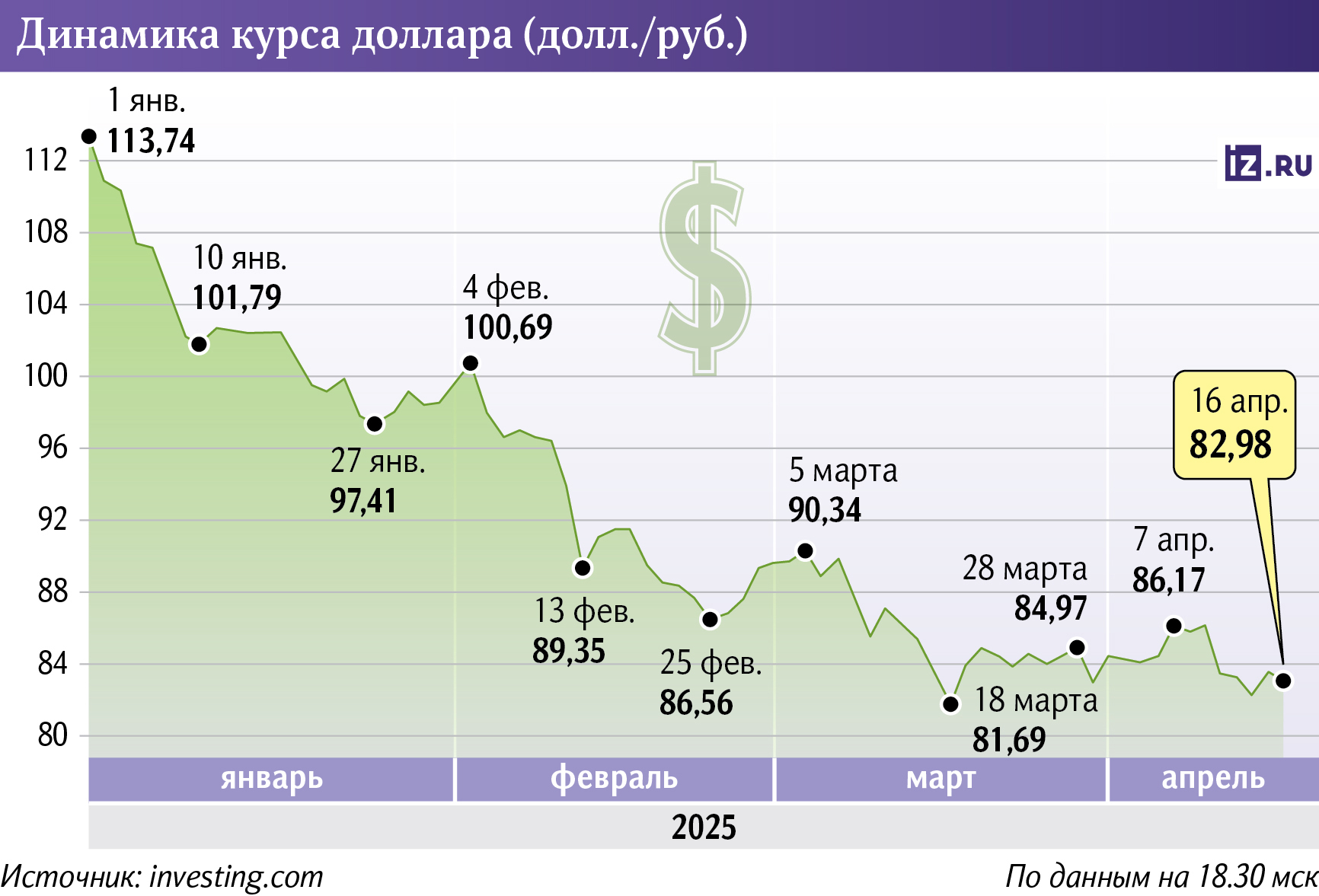

Spring weakening: the dollar may drop below 80 rubles in April

In April, the dollar's value may fall below 80 rubles in the short term due to inactive demand for the "American" from importers and high rates in the economy, experts interviewed by Izvestia predict. However, due to the geopolitical uncertainty over the settlement of the conflict in Ukraine and trade wars, as well as cheaper oil, the dollar will rise in price to 90 rubles by the summer, and by the end of the year it will go into the range of 95-100. Nevertheless, analysts expect that the ruble will be able to maintain its status as the most dynamic currency in 2025 - Bloomberg already gave it such a "title" in April. What will play in favor and against the course is in the Izvestia article.

Dollar exchange rate in April

On April 16, the dollar exchange rate dropped to 82 rubles/$ at the moment — it had already reached similar values in mid-March. And before that, the same indicator was only in the summer of 2023.

Since the beginning of the year alone, the ruble in the over-the-counter market has strengthened by 38% against the dollar, showing record growth against the "American" among all world currencies, Bloomberg analysts estimated. This allowed them to christen the Russian monetary unit as the most dynamic global currency in 2025.

At the beginning of the year, the ratio of exports and imports primarily played in favor of the ruble, explained Alexander Bakhtin, investment strategist at Garda Capital. After the New Year's surge in consumer activity in winter, demand for imports and, consequently, for foreign currency was expected to fall, while the inflow of export earnings remained stable. Moreover, oil prices rose in January, which increased the imbalance between the supply of foreign currencies and the demand for them.

— Large imports are often paid for from foreign accounts. The foreign exchange supply is substantial, but there is no demand from non—residents for foreign money," said Sergey Konygin, senior economist at Sinara Investment Bank.

The second reason is the persistence of high real rates in the economy, which have made the ruble attractive for capital returns, Kirill Kononov, an analyst at BCS World of Investments, listed.

Finally, the most important incentive was the improvement of the geopolitical situation between Moscow and Washington, as even the beginning of a dialogue on normalizing relations and reducing tensions in Eastern Europe increased the chances of easing sanctions pressure against Russia, concluded Vladimir Chernov, analyst at Freedom Finance Global. In addition, the dollar is getting cheaper against other world currencies due to the outbreak of trade wars.

In April, positive factors continue to influence the exchange rate. In the short term, the ruble may strengthen further, including for a while the dollar may go below 80 if speculative factors converge, Kirill Kononov predicted. If a quick consensus is reached in the negotiations, the "American" can really go below 80 rubles/ $, agrees Vladimir Evstifeev, head of the analytical department of Zenit Bank.

— The dollar is able to test the 80 mark, including due to the tax period at the end of April, when exporters will sell the currency to pay fees to the budget. However, a very significant geopolitical positive is needed to consolidate the indicators. Apparently, the ruble exchange rate is now at its annual peaks," says Alexander Bakhtin from Garda Capital.

What will be the ruble exchange rate in the summer of 2025

However, by the summer, the impact of negative factors will outweigh, experts interviewed by Izvestia fear. In the first half of April, the price of Russian Urals oil from Primorsk (Baltic Sea) fell to $52/bbl, recalled Finam analyst Alexander Potavin. By the end of the month, its value had decreased even more significantly. This factor will affect the ruble exchange rate with a lag of one and a half to two months.

The second factor that will play against the ruble is an increase in demand for the currency from importers and Russian tourists traveling abroad in the summer, said Dmitry Golubkov, Director of Macroeconomic Analysis at OTP Bank.

— The ruble is forecast to weaken slightly to 88-92 rubles per dollar in the summer due to a seasonal decline in export activity and a possible slowdown in the global economy. Goldman Sachs' forecast of reaching 100 rubles per dollar seems excessively pessimistic unless there is a serious escalation of geopolitical risks," said Vladimir Chernov of Freedom Finance Global.

Then, by the end of the year, the national currency may weaken even more — to the range of 95-100 rubles/ $, according to the majority of analysts surveyed. The ruble will gradually fall in the second half of the year due to lower oil prices and the restoration of import activity. And also — against the background of the Central Bank's transition to a reduction in the key rate, which is expected in the third quarter, explained Denis Popov, managing expert at the PSB Center for Analytics and Expertise.

Geopolitical changes will also be an important factor for exchange rates: whether the conflict in Ukraine will be resolved or suspended, whether sanctions against Russia will be lifted at least partially, and how Trump's trade wars will develop.

Nevertheless, the Russian monetary unit is likely to be able to maintain its status as the most dynamic currency, Dom.RF expects. Indeed, in 2025, the ruble entered at the level of 113 rubles / $. And even if it trades around 100 in December, it will still be 10-15% better than in January.

Most likely, the ruble will continue to show increased volatility, as current geopolitical events have a significant impact on it, Vladimir Chernov added. Many of them are currently at the peak of tension. Thus, it is likely that the national currency will retain its status as one of the fastest growing in 2025, he concluded.

Переведено сервисом «Яндекс Переводчик»