- Статьи

- Economy

- Paying for a long time: the average mortgage term in Russia has approached a record 26 years

Paying for a long time: the average mortgage term in Russia has approached a record 26 years

The average mortgage term in Russia has approached a record 26 years. And it has already reached 27 years in loans for housing under construction, the Central Bank told Izvestia. They added that people will plan to close more than half of the mortgage loans currently being issued in retirement. The reason is that the rates are too high, the housing is expensive, and the monthly payment for a shorter period is unaffordable. Now, if a person takes out a loan of 10 million at 30%, he will pay for almost eight apartments over the entire period. In general, the longer the loan term, the higher the risks, the Central Bank emphasized. However, clients usually repay the mortgage ahead of schedule. Are there any risks to the financial system due to lower incomes of citizens in retirement and when mortgages will become more affordable - in the Izvestia article.

For how many years do Russians take out a mortgage

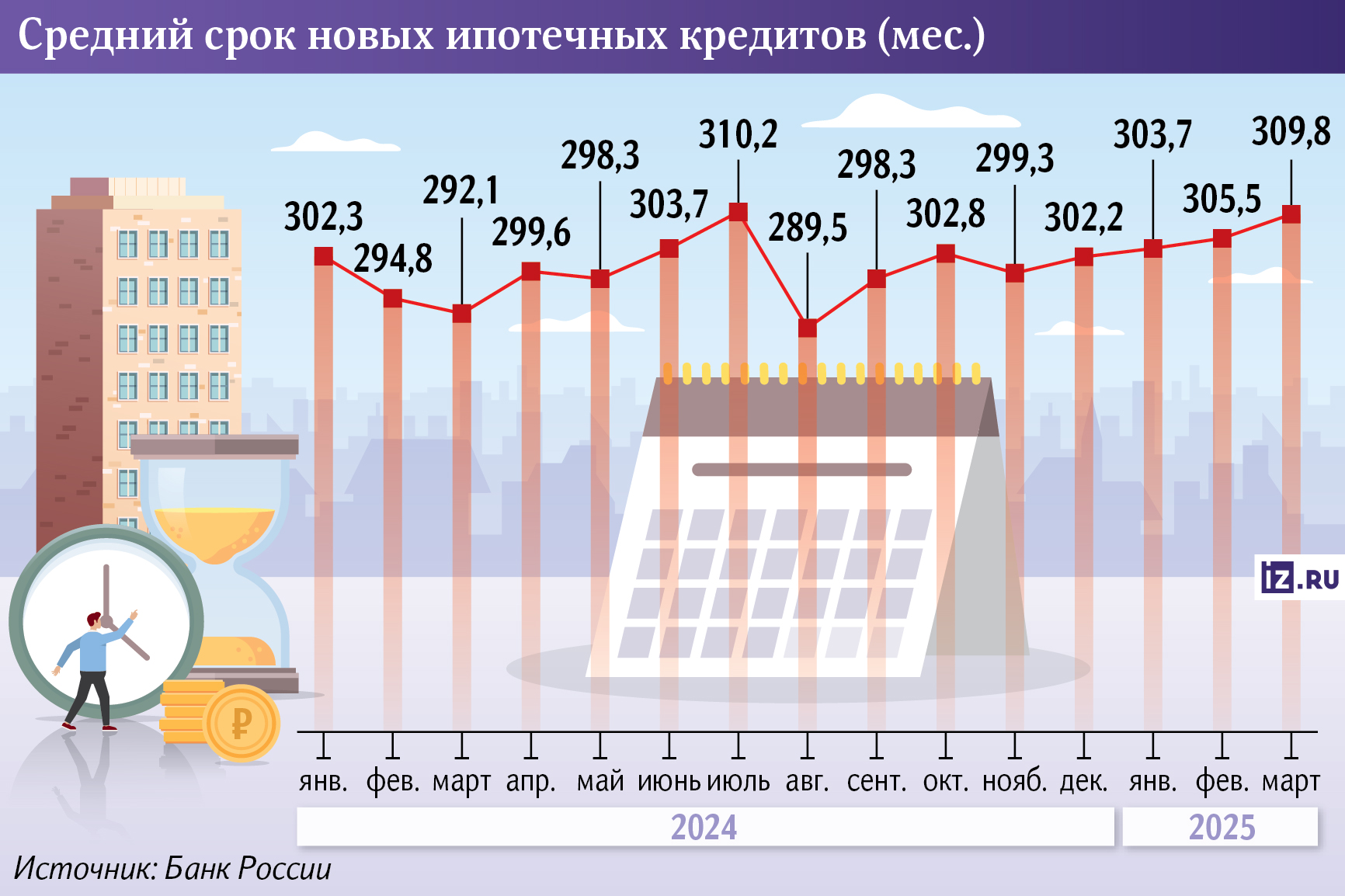

In Russia, the average term of mortgage loans has jumped. In February alone, the indicator increased by five months and approached a record 26 years, according to the Central Bank.

In February 2025, the average term for housing loans issued (both for new buildings and for secondary housing) reached 309.8 months, the press service of the Central Bank told Izvestia. At the same time, in the segment of mortgages for housing under construction, this figure reached almost 27 years (323 months) in February.

This trend is related to the rise in housing prices — in order for the monthly mortgage payment to remain affordable, banks and borrowers are forced to extend the loan term, the regulator explained. First of all, this concerns the primary market, said Irina Nosova, Senior Director of the Financial Institutions Ratings group at ACRA. She added: prices there continue to rise not so much because of the increase in cost, but because of the artificial overestimation against the background of preferential programs that apply to facilities from the developer.

Property prices in some regions are increasing by about 20% per year, added Ekaterina Samyshina, Managing Director of the mortgage lending group at Bank Saint Petersburg. To buy an apartment with a comfortable payment, clients extend the loan for 30 years.

The average term of a mortgage loan has now reached its maximum value, confirmed Dmitry Gritskevich, Head of Banking and Financial Market Analysis at PSB. According to him, this is due to several factors. Firstly, the share of preferential programs is growing among loans issued. According to the Central Bank, in February, only 13% of loans were issued on market mortgages, a record low.

Government programs allow you to get money on credit at a rate below inflation, so the motivation to repay debt faster is lower, explained Vitaliy Kostyukevich, director of Absolut Bank's retail products department. In addition, according to him, family mortgages are becoming more popular, and there the average age of the borrower is lower.

Another reason is the strict restrictions of the Central Bank on reducing the level of the maximum debt burden of borrowers (the client should not send too large a share of his regular income to repay debts), Dmitry Gritskevich from PSB continued. According to him, because of this, banks reduce the amount of the monthly payment, and this affects the loan term.

However, clients who do not have large debts also tend to take out a preferential loan for as long as possible, because the yield on deposits is now significantly higher than the mortgage rates with government support. This means that it is more profitable to deposit the available funds.

There is also a psychological factor, noted Ekaterina Samyshina from Bank Saint Petersburg. Against the background of economic instability, people prefer to take out "long" loans, hoping for refinancing in the future or income growth. Also, an increase in the term often becomes a kind of "safety cushion" for the borrower, allowing him to feel more comfortable, the VTB press service added.

This bank did not record an increase in the average mortgage term in February. However, they noted that since the beginning of 2025, new loans have been taken for an average of 27 years. Compared to last year, this figure has increased by 12 months.

Up to what age do people pay their mortgage

Currently, borrowers will plan to close more than half of the housing loans already in retirement, the Bank of Russia told Izvestia. Previously, this figure was lower — in the second half of 2022, it was 39%. In general, the longer the loan term, the higher the risks, therefore, the Standard for Protecting the Rights and Legitimate Interests of Mortgage Borrowers recommends concluding contracts for no more than 30 years, the regulator added.

However, the actual maturity dates are usually much shorter than planned and amount to about 10 years, the Central Bank said. Therefore, now they do not see significant risks of over-crediting older customers.

The increase in the average term partly indicates that mortgages have become less affordable, said Evgeny Shavnev, CEO of the Flip real estate investment company. In addition, according to him, long—term loans are always a risk, because it is quite difficult to predict a client's solvency for 1-2 years, let alone 10-20 years.

The main danger for the lender is that after retirement, income may not be sufficient for comfortable loan servicing, warned Vladimir Stolnikov, head of the Alternative Investment Management Directorate at Alfa Capital Management Company. Your life circumstances may also change— your health, marital status, or economic situation—which will make paying off the loan even more difficult. In addition, the longer the term, the greater the total amount of interest that will have to be paid.

If a person takes out a loan of 10 million at a rate of 30% (this is the current real cost of a mortgage in the largest banks) and a down payment of 20%, he will pay for almost eight apartments over the entire term of the loan. This makes mortgages extremely unprofitable, Vladimir Stolnikov emphasized.

According to him, in order to minimize the risks of such a long mortgage, you need to plan your budget taking into account future income. And also to seek the possibility of early repayment.

The growth of the average mortgage term will continue until a steady trend towards lower rates is formed, the press service of Novikom Bank noted. When this happens and the standard market programs start working, the loan term will begin to shorten.: Since the main category of borrowers is traditionally people just over 40 years old, and they are interested in paying off debts before retirement, added Vitaly Kostyukevich from Absolut Bank.

In addition, with lower interest rates and deposit yields, people are likely to start paying off their mortgages more often, predicts Dmitry Gritskevich from PSB.

The Central Bank may begin to ease monetary policy by the autumn, Ekaterina Samyshina from Bank Saint Petersburg expects. However, a significant reduction in the key rate will be no earlier than in two years, predicts Vladimir Stolnikov from Alfa-Capital Management Company. Then the mortgage will become more affordable. Now, in fact, only state programs remain for clients.

Переведено сервисом «Яндекс Переводчик»