- Статьи

- Economy

- Financial Literacy course: Authorities are studying other currencies for NWF investments

Financial Literacy course: Authorities are studying other currencies for NWF investments

The authorities may start replenishing the NWF with new currencies, such as dirhams. Currently, the money in the pot is stored in rubles and yuan, but the PRC currency has fallen in price by 1% in the last week alone amid trade wars. And in order to make exports from China more profitable, the Communist Party may continue to weaken the yuan. Savings need to be diversified to protect themselves from risks, experts say. However, so far the Ministry of Finance is only assessing the possibility of changing the currency structure of the NWF: for this, it has placed a tender for a study. Why changes are needed right now and what is good about dirhams is in the Izvestia article.

What currencies are used to replenish the NWF?

The Ministry of Finance has posted on the public procurement portal a contract for information and analytical work related to the management of public financial assets. Izvestia has reviewed the document. The winner of the bidding has already been determined — it turned out to be the Center for Macroeconomic Analysis and Short-term Forecasting (CMAKP). The contract amount was 7.9 million rubles. The deadline for its completion is December 31, 2025 inclusive.

As follows from the contract, among other things, the Ministry of Finance ordered an analysis of the state of the economies of states in whose currencies it is possible to place funds of the sovereign wealth funds of the Russian Federation (the main of them is the National Welfare Fund, NWF). The Russian Ministry of Finance conducts market research on an annual basis, they are not related to changes in the currency structure of the NWF, such changes are not planned, they told Izvestia. The editorial board sent a request to the CMACP.

Such a purchase indicates that the Ministry of Finance is exploring the possibility of investing money in NWF in new currencies, explained Alexey Tarapovsky, founder of Anderida Financial Group.

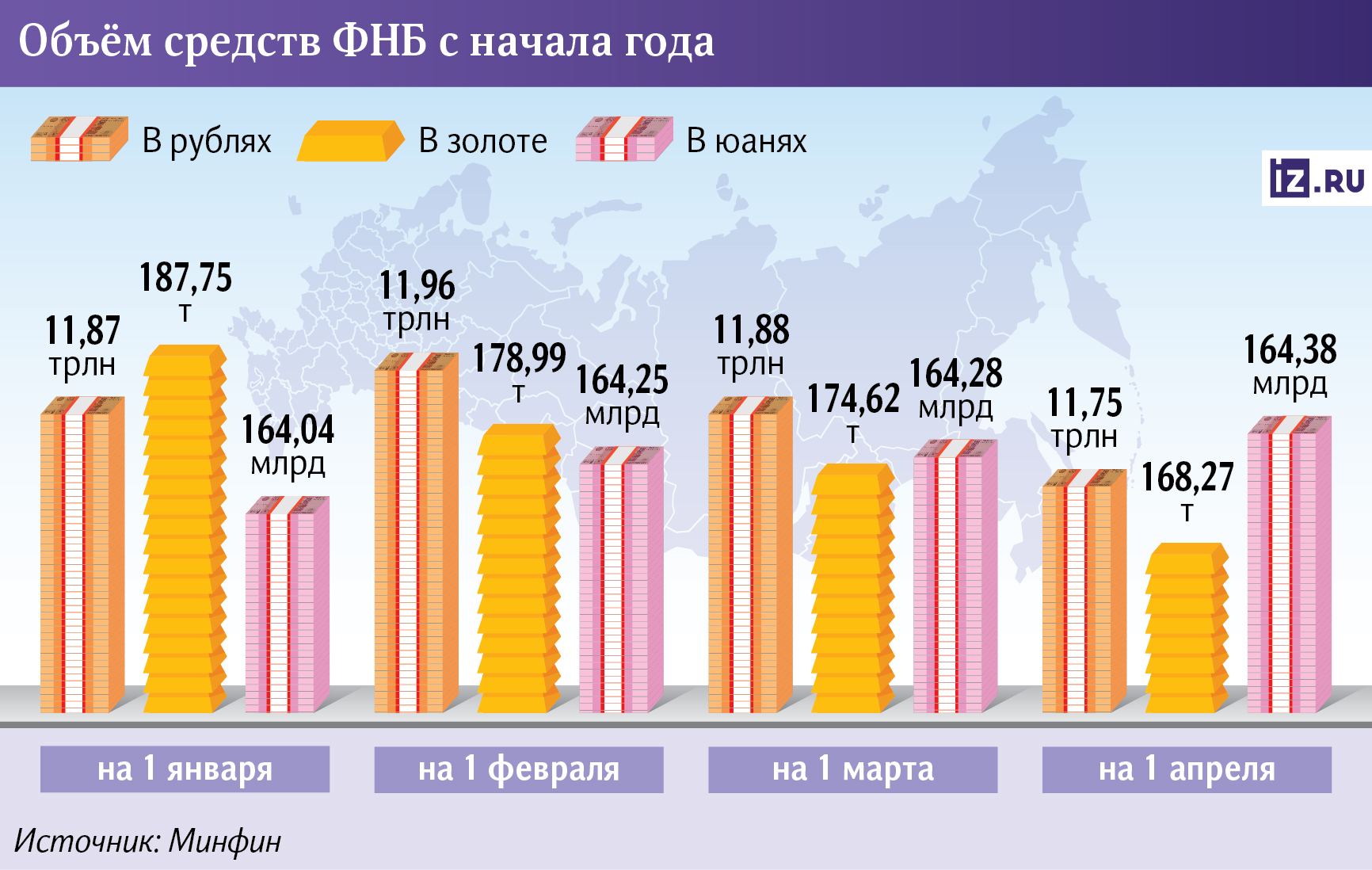

The National Welfare Fund is also called a bucket — the authorities transfer funds from additional oil and gas revenues there, and then they can use the liquid part to support the economy when required. In March, its volume amounted to 11.75 trillion rubles, the Ministry of Finance reported.

NWF funds are mainly held in yuan: 164 billion yuan, or about 1.9 trillion rubles. A relatively small part is held in rubles — 1.6 billion rubles. The rest lies in the form of gold in the accounts of the Central Bank, as well as in shares of large companies (for example, Sberbank, Russian Railways, Aeroflot).

Previously, the funds of the "pot" were also stored in Western currencies, but in July 2021 dollars were excluded from there. And in December 2022, the Ministry of Finance excluded the euro, yen and pounds sterling from the fund's currencies. In the new structure, the agency planned to place up to 60% in yuan.

But it is dangerous to keep money in virtually the only foreign currency, it is necessary to diversify investments, said Lazar Badalov, associate professor at the Faculty of Economics at RUDN University.

— At the moment, in fact, Russia has only one foreign source for storing savings — the yuan. Therefore, the Ministry of Finance seeks to analyze the existing opportunities for placing reserves in other friendly currencies," he said.

Why is the yuan falling due to trade wars

In addition, the risks of investing in the yuan are now growing: trade wars may weaken the "Chinese". To confirm its tough stance of confrontation with the United States regarding duties, on April 8, Beijing lowered the fixed yuan exchange rate to 7.20 per dollar, the lowest since September 2023. The weakening of the Chinese currency should increase the competitiveness of exports from this country in the face of tariff threats. Over the past week, during which the trade confrontation reaches new peaks, the Chinese currency has already fallen in price by 1.1%, and over the past month — by 1.5%.

The US has increased duties on China to a total of 104% since April 9. According to the White House, dozens of countries already want to negotiate lower rates (the measure will affect 185 states and regions), but China is determined to defend its rights. On April 9, Beijing announced an increase in retaliatory duties on American goods to 84%.

Goldman Sachs analysts expect China to continue easing monetary policy. In 2015, Beijing forcibly devalued its currency, a decline of a record 1.9% per day, Alexei Tarapovsky recalled. That is, China still has a reserve for decisive action.

It is still difficult to predict how long Beijing will adhere to this policy, says Ivan Potekhin, Director of Customer Relations at BCS World Investments. He believes that such a measure can be used to mitigate the shock of the tariffs in the short and medium term. However, in the long term, the weakening of China's currency may lead to an outflow of capital from the country, the expert warned.

What currencies can the NWF money be invested in?

The experience of previous years has taught everyone that it is not worth focusing on one currency for the security of the entire economy, said Alexei Tarapovsky. Keeping savings only in yuan can be unprofitable and even dangerous from the point of view of the depreciation of the national welfare fund, he added.

— The placement of funds of the sovereign funds of the Russian Federation in the currencies of other countries is important, as it is an element of a strategy to reduce dependence on exchange rates in other countries. This approach can ensure an increase in the profitability of reserves," said Vladimir Eremkin, senior researcher at the IPEI Structural Research Laboratory at the Presidential Academy.

In today's conditions, the dirhams seem to be the most attractive for placing NWF funds, except for the yuan, according to Mikhail Khachaturian, Associate professor of the Department of Strategic and Innovative Development at the Higher School of Management of the Financial University under the Government of the Russian Federation. The exchange rate of this currency is pegged to the dollar. This means that regardless of fluctuations in global currency markets, the value of the dirham remains constant relative to the American dollar.

The most suitable currency for investing in NWF is the dirhams, Alexey Tarapovsky agrees. It has a stable exchange rate pegged to the dollar, and the UAE economy is quite stable, the country is not involved in either military or trade conflicts. The currencies of other large states look less attractive: for example, the Indian rupee is not freely convertible, and the Turkish lira is weakening too quickly and uncontrollably.

After the events of 2022 with the freezing of the Central Bank's assets denominated in dollars and euros, the Ministry of Finance strives, on the one hand, to ensure maximum profitability from these funds, and on the other — protection from possible blockages, Mikhail Khachaturian added.

Переведено сервисом «Яндекс Переводчик»