Deposit sentiment: average deposit rates dropped below 20%

The average yield on deposits for periods from three months to a year has dropped below 20%, Izvestia found out. Over the past month, conditions have worsened in one way or another for all major banks. By the next meeting of the Central Bank, the rates were below the key level. This is a normal situation: before that, yields, on the contrary, were overestimated. All this means that the market is not expecting a tightening of the regulator's policy and is counting on its easing, but not in March, but only in the second half of the year. Nevertheless, now Russians should take advantage of the still attractive conditions for savings products. How much and when deposit rates will decrease is in the Izvestia article.

What deposit rates do banks offer?

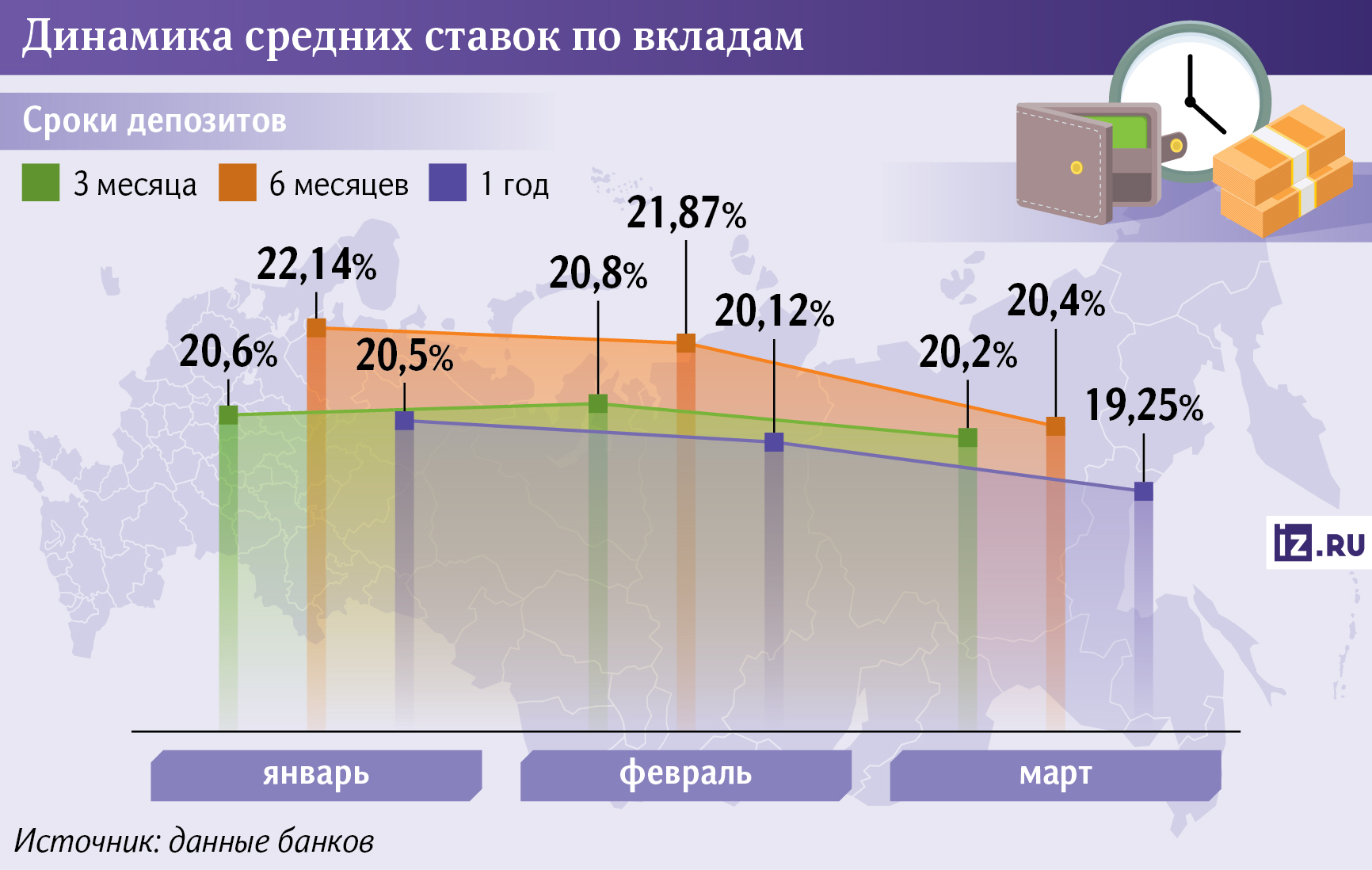

By mid-March, average deposit rates had dropped below 20% for periods ranging from three to 12 months, according to data from the websites of the top 10 banks in terms of public funds raised (Izvestia studied these resources). Over the past month, the yield decreased by 1 percentage point and reached 19.9%. They dropped before the Central Bank's key rate meeting, which will be held on Friday, March 21.

Deposit rates fell the most for six months — from February 17 to March 17, they decreased by an average of 1.5 percentage points and reached 20.4%, according to data from the websites of credit institutions. The profitability of such deposits remains the highest, but it has already dropped below the key level.

The trend is visible on other dates as well. Deposit rates for the year decreased by almost 1.3 percentage points and fixed at about 19.25%, Izvestia found out. The yield on short-term deposits for three months reached 20.2% per annum, having decreased by 0.6 percentage points since mid-February.

At the same time, the market is currently focused on short-term offers, the representative of "Compare.<url>": three—month deposits account for 35% of products, and semi-annual deposits account for a quarter.

Over the past month, rates on certain deposits have fallen for almost all credit institutions from the top 10, according to Izvestia. Only MKB and Dom Bank.The Russian Federation" increased yields for a period of three months, but still reduced them on deposits for six months and a year.

However, customers can still find great deals. The maximum rates in the largest banks are 23% per annum, the press service of the financial marketplace Finuslugi told Izvestia.

Why are deposit rates going down

"Rates on deposits with a maturity of up to a year are decreasing because the market expects that it is on this time horizon that the cycle of lowering the key rate is likely to begin," explained Yuri Belikov, managing director of the Expert RA rating agency.

Indeed, the Central Bank's policy easing should not be expected until mid-2025, according to Anna Zemlyanova, an analyst at Sovcombank. MTS Bank noted that the key rate will be reduced no earlier than the meeting of the regulator scheduled for June 6.

But we shouldn't expect any downward steps at the next meeting. It follows from Izvestia's consensus forecast that on March 21, the Central Bank will keep the key rate at 21%. So far, the regulator does not have enough reasons to reduce it, the RSHB press service clarified. Price growth is slowing down slowly and remains at an elevated level, despite a decrease in lending.

—Prices in Russia are steadily rising by 0.15–0.23% every seven days, and to reduce the key weekly inflation rate, it is important to stabilize at 0.1%," explained Peter Arronet, chief analyst at Ingosstrakh Bank.

The trend towards an active strengthening of the ruble may have a positive effect on the rate cut, said Svetlana Frumina, economist at Plekhanov Russian University of Economics. On the day of the conversation between the presidents of the Russian Federation and the United States, Vladimir Putin and Donald Trump, on March 18, the "American" gained a foothold below 82 rubles / $. In addition, since the beginning of the year, the Russian currency has strengthened by a third — this is a very serious dynamic, said economist Andrei Barkhota.

However, the trend towards the strengthening of the ruble will not last long, fears Natalia Pyrieva, a leading analyst at Digital Broker. Imports from the Russian Federation will begin to recover after a seasonal weakening in January – February, which will increase the outflow of currency from the country. In addition, Brent prices have decreased by more than 10% since the beginning of the year (while Russian hydrocarbons are now being sold at a discount), which may further reduce the income of exporters. In the near future, the ruble will resume its movement to the level of 90 rubles / $, the company's experts believe.

Since companies do not expect that the positive trend will continue for a long time, they do not include it in the cost of goods. That is, it is unlikely that the strengthening of the ruble will significantly affect inflation.

Is it worth putting money on deposit

It is completely unprofitable for banks to maintain high deposit rates, and if possible, players will actively reduce them, warned economist Andrei Barkhota.

Yields on deposits will continue to decrease in the near future, even if the Central Bank does not change the key one, says Igor Dodonov, an analyst at Finam Financial Group. At the same time, the process will definitely accelerate as the turnaround in the regulator's policy approaches.

The most likely and standard scenario is if the maximum deposit rate is 2-3 percentage points lower than the key rate, said Andrey Barkhota. This means that even before the Central Bank's policy easing, savings yields will fall into the range of 17-18%, and by the end of 2025 they will collapse to 12-15%.

Those who want to record a high return on savings for a year should hurry up with making a deposit, Andrey Barkhota advised. The rates on them decrease more quickly, and for deposits for 3-6 months they still remain close to 20%.

Deposits are profitable now anyway, and in general, they are likely to remain attractive in the future, Finam is confident. The rates on them will somehow guarantee higher returns compared to other market instruments with virtually zero risks.

VTB expects the savings market to continue to grow — in 2025, its volume will exceed 68 trillion rubles, the organization's press service emphasized.

Переведено сервисом «Яндекс Переводчик»