- Статьи

- Economy

- If they pull, they will not reach it: the average pension in the Russian Federation has sunk below a third of the salary

If they pull, they will not reach it: the average pension in the Russian Federation has sunk below a third of the salary

The average pension in the Russian Federation has dropped below a third of the salary — this is a record low since 2017, the Association of Non-Governmental Pension Funds calculated for Izvestia. The main reason is that salaries are growing at a faster pace, and unevenly across industries, while pensions are indexed to official inflation. According to international standards, the "pension replacement rate" should be at least 40%. However, as specified in the All—Russian Research Institute of Labor of the Ministry of Labor, in international practice it is estimated for a "typical recipient" - for example, a locksmith or a turner. According to this method, the figures in Russia are above the established level. At the same time, the indicator in some European countries, such as Lithuania, Poland, and Estonia, is much lower. How the situation in Russia may change in the future and what to do to ensure your old age is in the Izvestia article.

How much do Russians lose when they retire

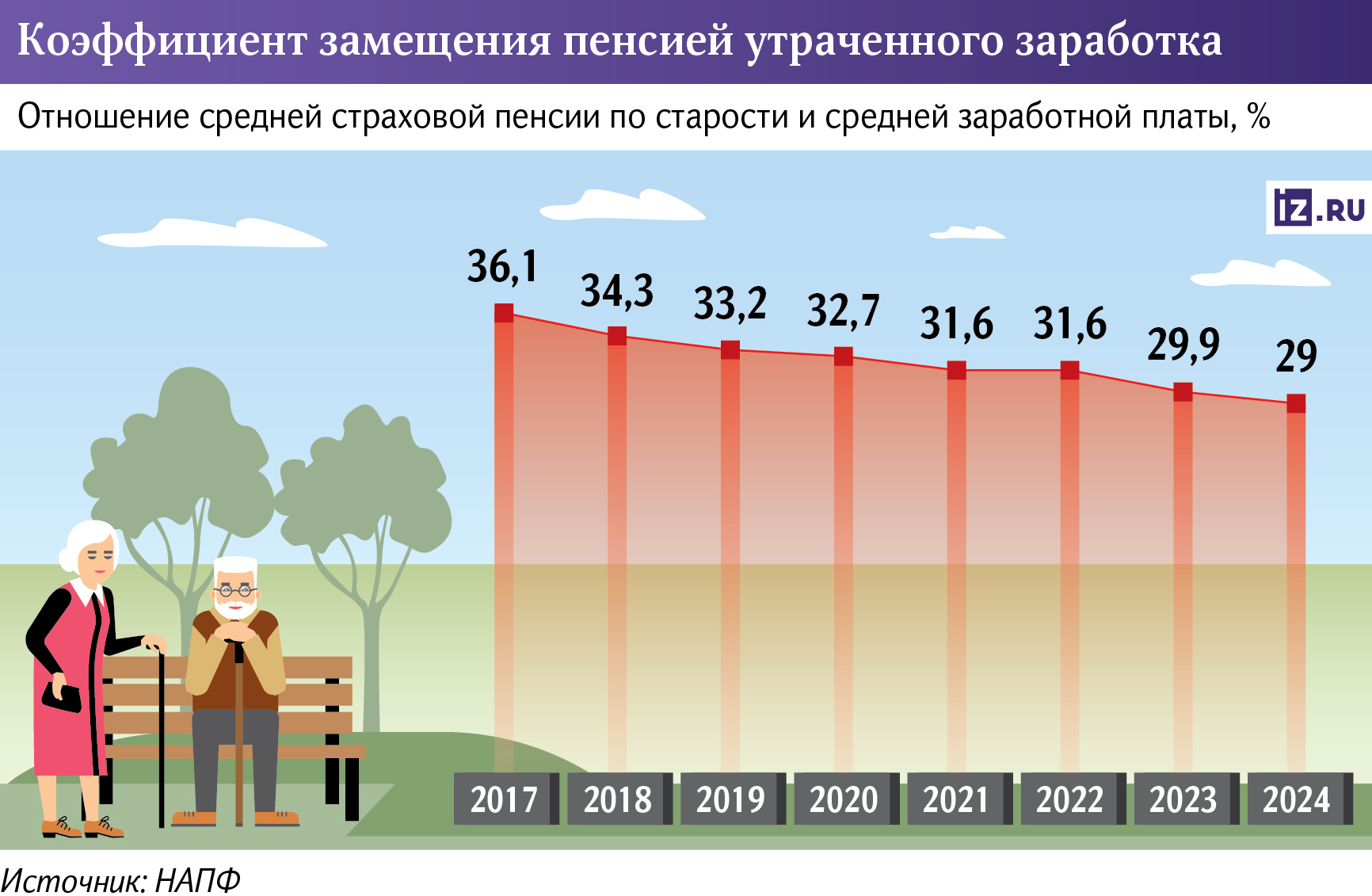

In Russia, at the end of 2024, the average old-age pension was 25 thousand rubles, and the salary was 86 thousand rubles. Accordingly, when elderly people reach old age, they receive from the state less than a third (29%) of the earnings they could receive if they worked, the National Association of Non-Governmental Pension Funds (NAPF) has calculated (Izvestia has the document).

This indicator is the lowest in Russia since at least 2017, when the coefficient was at 36%, according to the NAPF study. It gradually decreased: in 2023, it was one percentage point higher than in 2024— 30% versus 29%.

The ratio of pension and lost earnings is called the replacement coefficient, which determines how effectively the system provides retirement income in return for earnings, explained Yulia Finogenova, Professor of the Department of State and Municipal Finance at Plekhanov Russian University of Economics. The International Labour Organization (ILO) recommends keeping it at at least 40%.

However, the All-Russian Research Institute of Labor of the Ministry of Labor told Izvestia that for a correct assessment of the indicator, it is important to take into account the methodology of its calculation from different organizations.

— It is a common practice in the public space to compare average salaries with average pensions and call the results of this comparison the replacement ratio. Whereas this is a much more complex indicator, which reflects how much the recipient's earnings lost due to the completion of work are compensated, the All—Russian Research Institute of Labor estimated.

They explained: the ILO standard is set for the so-called typical recipient, whose income over 30 years of insurance experience corresponds to the salary of a locksmith or turner in mechanical engineering. If calculated in this way, the replacement rate for these specialties in Russia is 46% with 30 years of insurance experience and 40.5% with reduced coverage (with 15 years of experience in the realities of Russian pension legislation).

How salaries and pensions are growing in Russia

One of the main reasons for the gradual decrease in compensation after the loss of earnings is actually quite positive — this is a record increase in income for Russians in recent years due to an acute shortage of personnel, explained Vladimir Chernov, analyst at Freedom Finance Global. According to him, salaries outstripped price increases, while old-age payments were indexed according to the official inflation rate (9.5% in 2024). Nevertheless, the comparison of average old—age payments and average incomes is relevant - it reflects the well-being of pensioners in the current conditions.

At the same time, the All-Russian Research Institute of Labor believes that it is not reasonable to compare today's average salary with the pensions of Russians who have long since retired. Firstly, because incomes, unlike pensions, are growing unevenly: some people's salaries have increased by 20% over the past year, while others have remained at the same level.

In addition, the calculation of the average salary also takes into account ultra—high earnings, which do not participate in the formation of pension rights and are not subject to replacement - payments are made only from income up to a certain amount, from which insurance premiums are paid. As a result, the average pension is more uniform, as its size varies less between recipients: it is closer to the median salary, rather than the average.

However, there are other factors that reduce payments to the elderly. For example, the abolition of pension indexation for working citizens from 2016 to 2024, added Yulia Dolzhenkova, professor at the Financial University under the Government of the Russian Federation. This affected the amount of payments and affected the replacement rate. However, such indexing has been resumed since 2025.

What pensions are paid in European countries

In total, in the EU states by the end of 2023, the replacement rate (according to ILO estimates) was 58%, but the amount of payments in Europe may vary tenfold depending on the country, Vladimir Chernov noted. So, according to him, the pension in Iceland in 2024 reached € 2.8 thousand (about 270 thousand rubles at the exchange rate on March 6), and in Bulgaria — only €226 (22 thousand rubles).

The leaders in terms of replacement rates in the world are Portugal (98%), the Netherlands (93%), Turkey (95%), Julia Finogenova listed. However, in the case of the latter, it should be borne in mind that in real terms, pensions do not look so profitable due to the constantly cheaper lira. Lithuania (29%), Australia (31-34%), Estonia (34%), Poland (32%) were included in the anti-rating.

How to increase income in old age

Starting in 2026, pension indexation will be determined not only by inflation, but also by the additional income of the Social Fund, which arose due to the high growth rates of salaries, said Viktor Lyashok, senior researcher at the INSAP Center of the IPEI Presidential Academy. Therefore, according to him, it can be expected that the replacement rate will start to rise after all. There is another positive factor — the resumption of indexation for working pensioners, which will increase the incomes of working elderly people.

Yulia Dolzhenkova from the University of Finance believes that the replacement rate will still decrease. But first of all, because salaries for workers will grow faster than inflation, which will continue to be indexed to old-age payments. In addition, the number of self-employed people who do not have pension rights is increasing, which means that the Social Fund does not receive insurance premiums, the expert recalled.

Further faster pension increases and higher insurance contributions to the Social Fund will help to increase the level of compensation by involving new payers from the informal sector in the system — then the state will have more funds to raise pensions, the professor believes.

However, significant changes are unlikely, so those who are currently working should think about retirement in advance. In addition to classic savings on deposits and independent investments, there are other options. In order to earn income comparable to a salary in old age, you can get a job at a company that offers corporate pension programs, Vladimir Chernov added. There is also an option to become a member of the long-term savings Program (RSP).

PDS is a voluntary savings product for Russians over the age of 18, launched by the Central Bank and the Ministry of Finance. To participate in the program, you need to sign an agreement with a non-governmental pension fund and make contributions at your own expense. You can also transfer pension savings formed from 2002 to 2014, if any. In the first 10 years after joining the program, the state co-finances these investments up to 36 thousand rubles annually. There is also a tax deduction of up to 52 thousand per year.

— The replacement of lost earnings at the expense of the state pension alone does not allow ensuring a decent standard of living after completing a career. Thanks to the (PDS), the ratio of lost earnings to retirement can reach the recommended 40% by world standards," said Sergey Belyakov, President of the NAPF.

You can also move to work in the regions of the Far North, as the length of service in them increases the coefficient to a fixed payment, suggested Vladimir Chernov. Another option to increase your pension is to buy additional points before completing your work.

Переведено сервисом «Яндекс Переводчик»