Shadow payment: mortgage arrears have jumped one and a half times

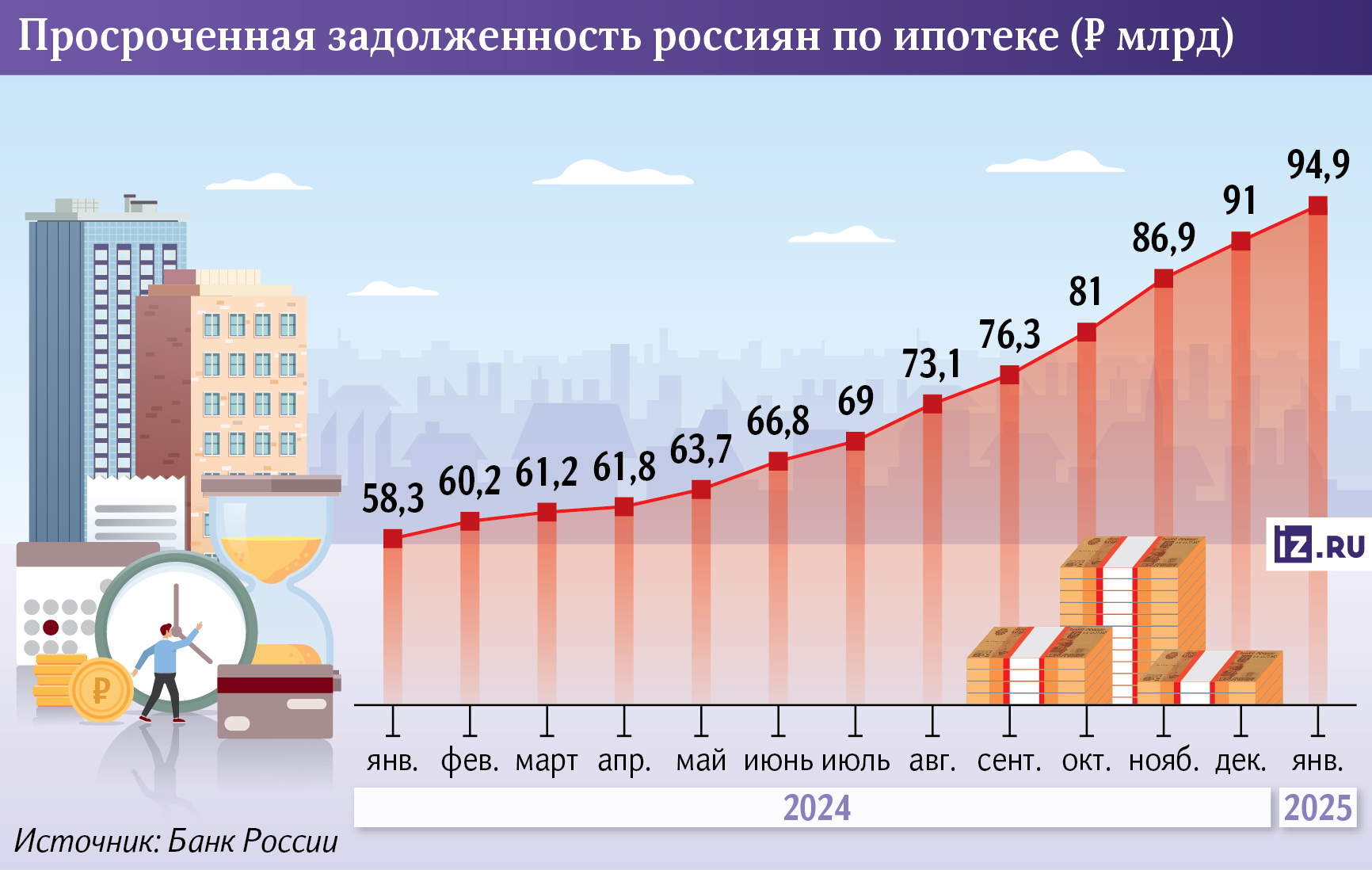

The overdue mortgage debt of Russians in 2024 increased by 63% to 95 billion rubles, according to the Central Bank. These are the highest figures in history. In recent years, housing loans have been issued en masse in Russia, but now, against the background of high inflation, borrowers are having problems with payments. While delinquency accounts for less than 1% of the mortgage portfolio, it does not threaten financial stability, but a sharp increase raises concerns. Because of this, the Central Bank and banks may further tighten the conditions for approving housing loans in order to reduce their risks. What a person should do if he cannot cope with the mortgage, and when the bank has the right to take away the apartment — in the material of Izvestia.

Why Russians are more likely to default on mortgages

Russians have become more likely to default on their mortgages. In 2024, the volume of "bad" debts increased by 63%, to 95 billion rubles, according to the Central Bank. At the same time, the total amount of housing loans to citizens grew much more slowly — by only 7%. At the beginning of January 2025, it reached 19.2 trillion rubles.

According to these statistics, the volume of mortgage delinquencies has reached its maximum in the entire history of observations, said Evgeny Shavnev, CEO of Flip LLC, an investment company in the real estate market.

Such a sharp increase in overdue debt may be due to the active issuance of housing loans in previous years, says Anna Zemlyanova, chief analyst at Sovcombank. So, in 2023, the total mortgage portfolio of Russians increased by 4.2 trillion rubles, and in 2022 — by 2.1 trillion rubles.

Until July 2024, there was a massive preferential mortgage on new buildings at 8%. The opportunity to buy real estate at minimal interest rates encouraged many to take out a mortgage without fully assessing their financial strength, Evgeny Shavnev emphasized. That's why they started talking about the mortgage bubble last year.

Those who did not fall under the terms of preferential programs took out a market mortgage, said Natalia Milchakova, a leading analyst at Freedom Finance Global. But in recent years, rates have been high and have only continued to rise, making it impossible to refinance at a more favorable interest rate, as a result, housing loans have become an unbearable burden for some.

Previously, mortgage borrowers were the most disciplined and the vast majority of delinquencies related to unsecured loans, the expert noted. However, in 2024, the situation has changed for the worse, Natalia Milchakova emphasized.

A decrease in real incomes of the population, inflation and economic instability could lead to a deterioration in the financial situation of borrowers, Maxim Kolyadov, head of work with individuals at Insurance Broker AMsec24, added. According to him, the increase in mortgage arrears signals financial difficulties among the population and indicates the need for a more attentive approach to lending.

Will housing loans be tightened

A sharp increase in delinquency is a significant disadvantage for the banking system, as it worsens the financial performance of market participants themselves, Natalia Milchakova continued. She explained: for each "doubtful" borrower, it is necessary to create a reserve for possible loan losses according to the requirements of the Central Bank. Therefore, financial institutions themselves will be screening out new applications more harshly in the near future.

However, the current situation is far from critical, and it does not threaten financial stability. After all, the share of delinquencies in the total mortgage portfolio does not exceed 0.5%, estimated Evgeny Shavnev from Flip. Despite the increase in overdue debt, the quality of the banks' mortgage portfolio remains good, Anna Zemlyanova from Sovcombank is confident.

In addition, only very few people are ready to apply for a mortgage due to the high interest rate. This will have a positive impact on the quality of the portfolio in the future, Evgeny Shavnev added.

But a sharp increase in delinquency is already a wake—up call, so the Central Bank will probably continue to tighten the requirements for mortgage borrowers: from raising the initial payment to, possibly, mandatory confirmation of income only through Public Services, says Natalia Milchakova from Freedom Finance Global.

For several years now, the regulator has been tightening quantitative restrictions on the provision of consumer loans to Russians with large debts. Starting in April 2025, the Central Bank will have the right to restrict and issue risky mortgage loans.

What to do if you are overdue on your mortgage

If the borrower realizes that he will not be able to pay the mortgage for some time, then the first thing to do is contact the bank, said Anna Zemlyanova. In case of temporary difficulties (for example, when quitting a job), a financial institution may offer to restructure the loan. For example, you can reduce the monthly payment by extending the loan term, explained Anna Gondusova, Head of Product Development at Alfa Capital Management Company.

Another option is to take mortgage holidays. Some market participants provide their own programs that allow you to temporarily stop loan payments in case of financial difficulties.

A similar government mechanism has been operating in Russia since 2019. The borrower may request a delay in repayment of the mortgage for up to six months if he finds himself in a difficult life situation. Their list is prescribed in the law. Among them is the loss of a job and temporary disability for a period of more than two months. However, the loan amount at the time of issue should not exceed 15 million rubles.

— The borrower himself must assess his situation as realistically as possible. If the situation is such that there are few chances to restore solvency, then it is worth considering the option of selling real estate and buying something cheaper," concluded Anna Gondusova from Alfa Capital.

If a person has not used any of the programs, then a delay of more than three months becomes a reason for the bank to collect the debt prematurely through the court, taking into account missed contributions, interest and penalties, was written earlier by Izvestia. If the borrower is more than 90 days late with the payment, his credit history will deteriorate, and it will become almost impossible to obtain a new loan in the future.

The bank will also have the right to take away mortgage housing on account of debt, even if it is the only one in the family. However, there is an exception: if the remaining amount of debt is less than 5%, you will not be able to pick up the apartment.

Selling an apartment by a bank through bidding is not the fastest procedure, said Evgeny Shavnev from Flip. However, lenders will not significantly reduce the price and will try to cover their expenses as much as possible. Therefore, this will not have a significant impact on the market and the cost of secondary housing, the expert is sure. There are few apartments in the entire market that banks have seized from customers due to delays and are trying to sell, and their sale is unlikely to significantly affect pricing. For the same reason, even despite the price difference between primary and secondary, this will not affect the financial stability of banks.

Переведено сервисом «Яндекс Переводчик»