Velmi is lower: will the authorities have to weaken the excessively strong ruble

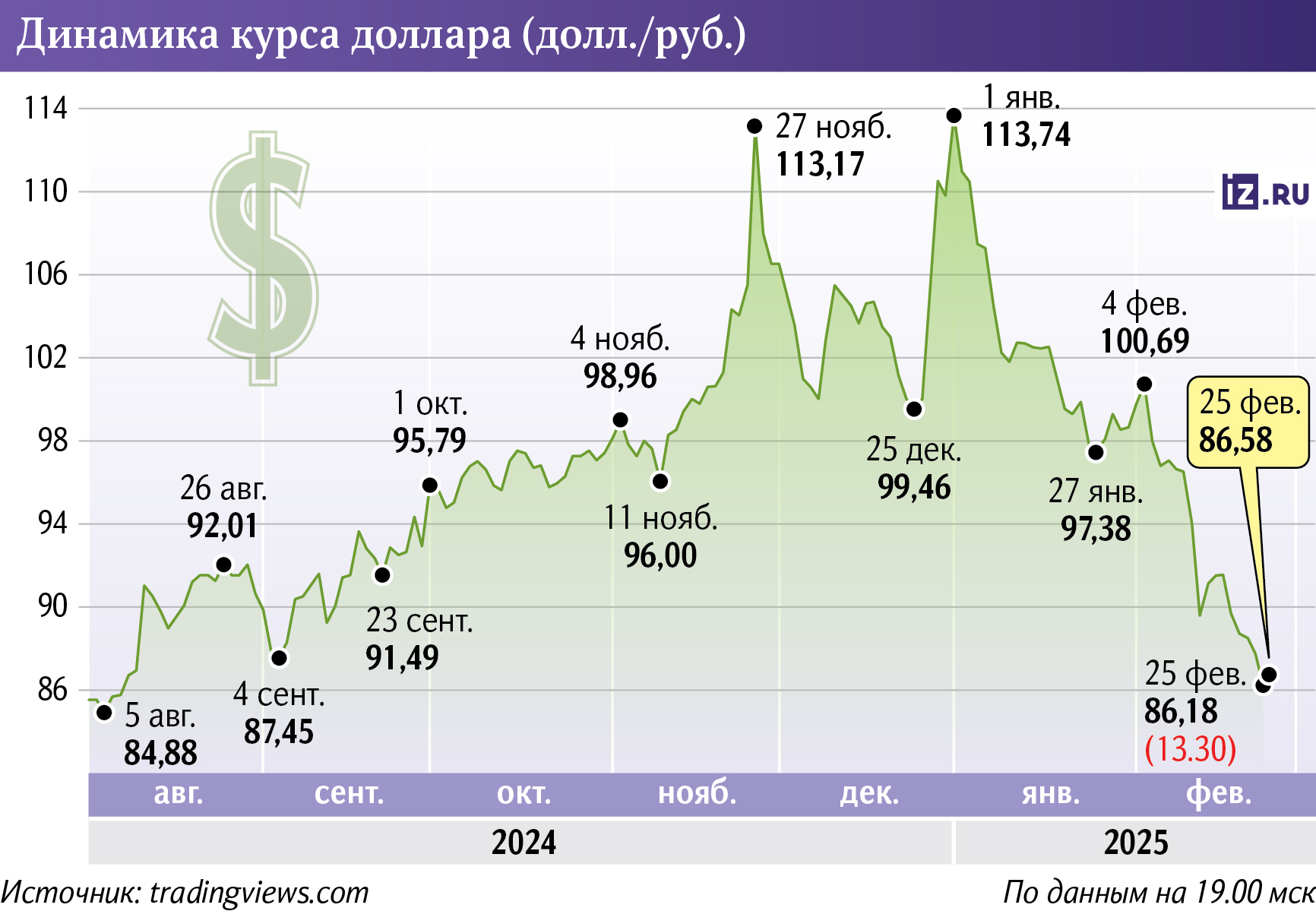

While maintaining positive news about the dialogue of the Russian Federation with USA the national currency will continue to strengthen gradually in March, and this trend can be called stable, experts interviewed by Izvestia expect. On February 25, the dollar has already dropped below 86 rubles, which is the lowest since August. But a positive scenario for the exchange rate could result in multibillion-dollar losses in oil and gas budget revenues, because the Ministry of Finance was counting on an average dollar of about 96 rubles in 2025. In this case, the authorities will have to intervene in the situation and return the national currency to a level convenient for all market participants. What the authorities can do is in the Izvestia article.

What will the ruble be like in March 2025

At the auction on February 25, the ruble exchange rate rose to the levels of August 2024 - at the moment it was trading at 85.75 per dollar and 90.2 per euro, according to Forex market data from TradingView. Since the beginning of the month, the national currency has strengthened by 15%, and since the beginning of the year — by almost 25%.

— A unique situation of "over—strengthening" of the ruble exchange rate was created in the Russian foreign exchange market in February, Finam analysts said.

The national currency is growing amid positive news about negotiations on the Ukrainian conflict and the establishment of a dialogue between the Russian authorities and the American ones, Finam noted.

Vladimir Chernov, an analyst at Freedom Finance Global, added that the reasons for the strengthening of the ruble are psychological, not fundamental. Investors are buying the national currency, expecting further warming in geopolitics and easing of sanctions against the Russian Federation. Fundamentally, nothing is happening with the exchange rate — the influx of foreign money into the Russian Federation has not changed, since there has been no sharp dynamics in exports or imports.

And at the end of the month, demand for foreign currency traditionally grows due to the approach of the tax period, Vladimir Chernov added to Global. In the coming days, exporters will convert their earnings into rubles, which will additionally support the exchange rate. The peak of payments falls on February 28, which means that a slight weakening of the ruble can be expected on or after that day.

However, it is too early to buy cheap dollars and euros for long—term investments - their value may still drop in the coming months, says Mikhail Zeltser, an expert on the stock market at BCS World of Investments. For those who want to purchase foreign currency for trips abroad or purchases of goods and services, it makes sense to do so in the coming week, because the exchange rate is now very profitable.

The ruble may still strengthen to the level of 84.5–85 per dollar, but its fair exchange rate is closer to the three-digit level, Finam emphasized. The national currency is now "overheated" — all other things being equal, its value will have to rebound. Due to this, investments in foreign money can show good returns.

How much does the budget lose from the strengthening of the ruble

Nevertheless, positive news about the possible end of the Ukrainian conflict may support the strengthening of the ruble up to 80 per dollar by mid-March, economist Andrei Barkhota admitted. In this case, the authorities will be forced to react and return the exchange rate of the US currency to the range of 92-95 rubles, artificially creating demand for it in the market.

The fact is that the budget for 2025 was drawn up with a forecast of an average annual exchange rate of 96.5 rubles per dollar and oil prices of $69.7 rubles per barrel Urals, said Olga Belenkaya, head of the Macroeconomic analysis department of Finam. Already, prices for Russian raw materials have decreased, and the dollar exchange rate is 10% lower than expected.

The strengthening of the national currency by just one ruble may lead to a reduction in oil and gas revenues by about 113 billion rubles, Olga Belenkaya estimated. This means that if we assume that the national currency will retain a value of about 86 per dollar (that is, in the most unfavorable case for the budget), the treasury will receive at least 1.13 trillion rubles (for comparison, total budget revenues this year are projected at 40 trillion).

However, the strengthening of the ruble this year is unlikely to be sustainable, Olga Belenkaya believes.

— Adaptation of the system to any geopolitical changes takes time, but eventually the exchange rate will return to an equilibrium value in the foreseeable future without government intervention, — says Vladimir Eremkin, an economist at the IPEI Presidential Academy.

In addition, it is important to understand that the Ministry of Finance expects the ruble exchange rate to be about 96.5 on average for the whole of 2025, and according to the results of the first two months, the indicator falls within these limits, Vladimir Chernov said. After all, back in January 2025, the "American" was trading at the exchange rate of 98-113 rubles. In the future, there is a risk that the national currency will fall in price again — then the budget will not suffer serious losses and it will not have to increase the deficit (which already amounts to 1.7 trillion rubles).

Nevertheless, if the ruble nevertheless falls below 80 per dollar, the authorities can really take measures to return it to the borders that are comfortable for exporters and the state. There are tools for this.

The authorities conduct large transactions with the currency on a daily basis, which affects its value. So, from February 7 to March 6, the Ministry of Finance buys 3.3 billion rubles worth of foreign money from the market every day, which is almost 20% less than a month earlier. Taking into account the mirroring of the Central Bank's previous purchase operations (which the regulator had previously postponed), about 5.5 billion rubles enter the foreign exchange market every day. Now it also supports the ruble and allows it to strengthen. In theory, the authorities can reduce this figure to allow the ruble to weaken.

The national currency exchange rate of about 90-95 per dollar is the most comfortable for the state, concluded Vladimir Chernov. At the same time, its strengthening would lead to a slowdown in inflation, since the prices of imported goods would decrease — but only if the trend becomes long-term. Nevertheless, it is highly likely that the ruble will return to previous levels even without government intervention.

Переведено сервисом «Яндекс Переводчик»