- Статьи

- Economy

- Payment is perfect: the share of the ruble in settlements for exports to Europe rose to a record 65%

Payment is perfect: the share of the ruble in settlements for exports to Europe rose to a record 65%

The share of payments in Russian currency for exports to Europe exceeded 65% in the third quarter and reached a record for the entire time of statistics, according to the Central Bank's data (Izvestia analyzed them). Transactions with the ruble are growing in trade with other regions, as well as in payments for imports. The situation changed dramatically in 2022, when sanctions were imposed on Russian banks, and the Russian Federation responded by demanding that energy resources supplied to unfriendly countries be paid for in rubles. All this increases the importance of the national currency on the world stage. However, due to the fact that Russia receives less foreign funds, the ruble exchange rate is weakening and provokes inflation. The high key rate should further support the ruble.

How the share of the dollar, euro and ruble in Russia's export payments is changing

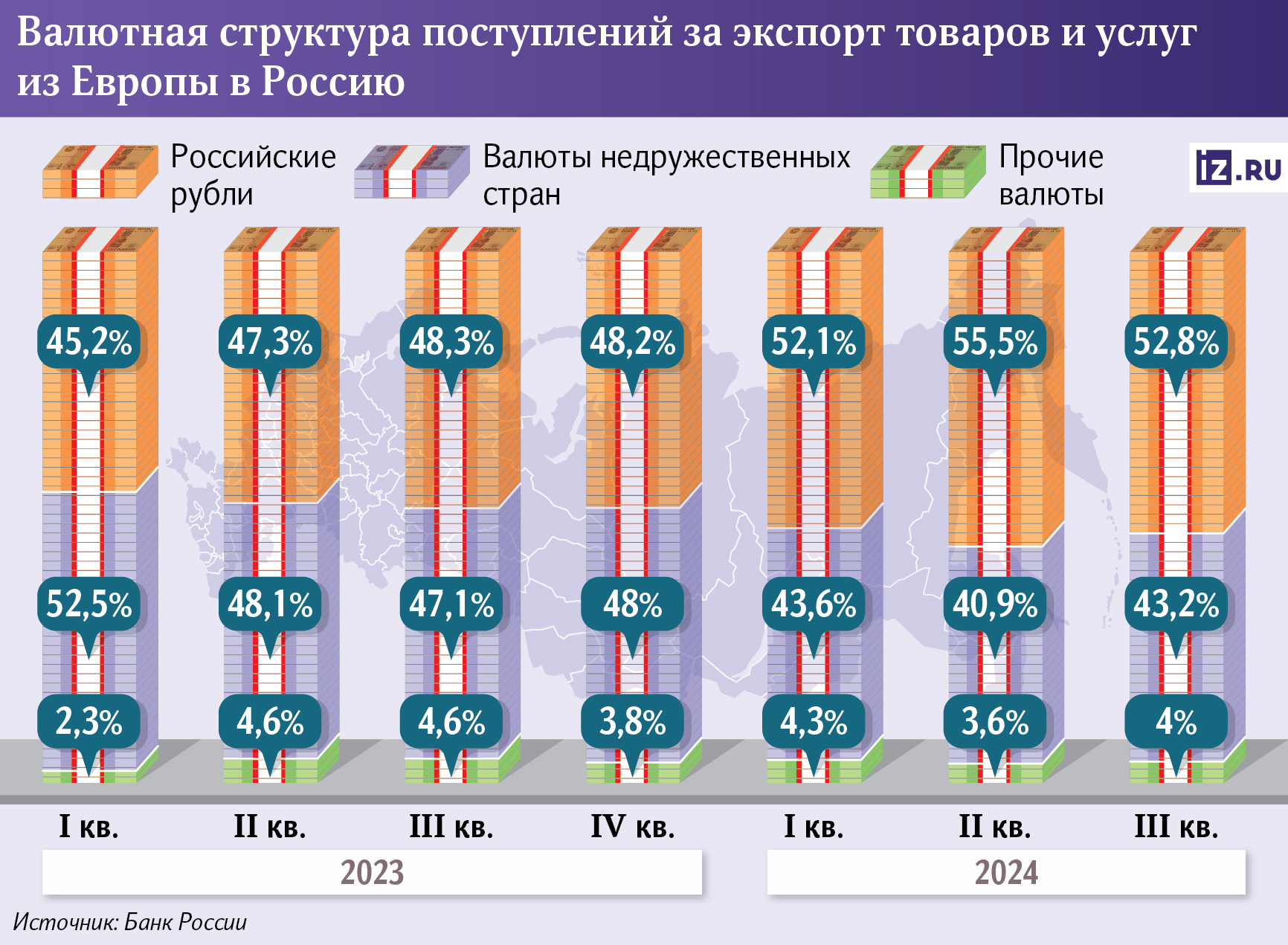

The share of the ruble in the calculations of Europe with the Russian Federation for Russian exports at the end of the III quarter of 2024 increased to 65.3%, according to the data of the Central Bank. This is the maximum for the entire period of observation - since 2019. At the same time, the percentage of settlements in the currencies of unfriendly countries is decreasing - to a minimum of 27.9%. Other monetary units account for the remaining 6.8%.

Over five years, the situation has changed dramatically. At the end of 2019, the share of payments in rubles for exports to Europe was only 19%. However, in 2022, after the introduction of large-scale sanctions against Russia, President Vladimir Putin signed a decree to convert payments for natural gas supplies to the EU and other unfriendly countries into rubles in order to abandon settlements in toxic currencies - dollars and euros.

Now, trade turnover with Europe is generally declining due to sanctions. However, Russia continues to supply energy resources there, which must now be paid for in rubles - this explains such a high figure for the national currency.

Settlements for exports in rubles are also growing in trade with other regions, follows from the regulator's data. In particular, in the third quarter, they accounted for 68% of payments from Africa, and from Asia - 37%. Across all regions, the share of our currency in settlements with the Russian Federation amounted to 41%, and in toxic monetary units - 17% (the rest was accounted for by the national currencies of other states). "Izvestia" sent an inquiry to the Central Bank.

Also in the third quarter, the share of the ruble in import payments increased - in all regions it approached 46%. At the same time, other currencies account for about 33% of payments, while monetary units of unfriendly countries account for 21%. That is, in our money foreign partners not only pay for the products they need, but are also ready to receive money for their goods - thus, the ruble is already in demand abroad.

Why ruble settlements are growing

Transactions with the ruble are increasing due to sanctions, which make it difficult to conduct transactions in Western currencies with Russian financial organizations, according to Alexander Potavin, analyst at Finam Financial Group. However, the need for trade relations with Russia remains, so all parties are looking for new options for cooperation.

The ruble is most actively used in settlements in trade with Armenia, Belarus, India and African countries - these are the main trading partners of Russia, emphasized Antonina Levashenko, head of the Center-OECD IPEI of the Presidential Academy.

We also have well-developing relations with the BRICS and EAEU countries, said Natalia Milchakova, a leading analyst at Freedom Finance Global. The state also trades with China and Turkey in the national currency, the expert noted. She admitted that taking into account the tendencies to dedollarization, all BRICS countries will switch to settlements in their national currencies in 2025-2026, and eventually - in the state digital currencies.

- The dynamics of settlements in rubles for exports and imports shows that the Russian economy is gradually becoming more independent and confident, and the ruble is becoming a currency in demand not only inside the country, but also abroad. Many Russian companies can now organize their work so as to be less dependent on fluctuations in the dollar or euro," explained Venera Shaidullina, Associate Professor of the Department of Global Financial Markets and Fintech at Plekhanov Russian Economic University.

However, so far the importance of the dollar has not decreased significantly, as more than 55% of international reserves of the world's central banks are still stored in this currency, added Natalia Milchakova. The role of the euro is also declining - its share in international payments via SWIFT fluctuates within 18-24%.

How settlements in rubles affect exchange rates

The less payments for exports in foreign currency, the less foreign money comes into the country, but the demand for them decreases not so significantly, said analyst of FG Finam Alexander Potavin. Accordingly, the less stable the ruble will feel in the medium term.

The government has previously introduced a requirement for the mandatory sale of foreign currency earnings. Now exporters must transfer to the country 60% of revenues in foreign currency and convert 25% of them.

In November, the national currency broke through the mark of 100 rubles/$. As estimated by Izvestiya experts, this contributes to the overall inflation. However, the increase of the key rate, which is expected at the meeting on December 20, should restrain not only the price growth, but also the weakening of the ruble - instruments in the national currency become more attractive, which increases the demand for the ruble and reduces it for foreign money.

The impact of cross-border transactions in national currencies on the ruble exchange rate in general will change.

- If export settlements are made in rubles, the demand for the national currency by foreign partners increases. This creates a more stable foundation for the ruble exchange rate - the more it is used in international transactions, the stronger its position becomes," Venera Shaidullina from Plekhanov Russian Economic University is sure.

She emphasized that it is important for the economy that the national currency is not just a formality, but is used actively and widely. Then its exchange rate will be less vulnerable to external shocks.

In 2025, we can expect both the growth of export volumes and expansion of its nomenclature, said independent expert Andrei Barkhota. The share of ruble settlements may not increase, but the contribution of exports to GDP will be disproportionately greater.

Russia is also developing other methods of international payments. Now money can be delivered, for example, with the help of cryptocurrencies - in the near future it is planned to launch an experimental legal regime for cross-border payments with digital currencies. Also, the Russian Federation has already conducted the first cross-border transactions using digital financial assets (DFA), Izvestia wrote earlier.

Переведено сервисом «Яндекс Переводчик»