- Статьи

- Economy

- Apartments under the key: the share of preferential mortgages for new buildings exceeded 90%

Apartments under the key: the share of preferential mortgages for new buildings exceeded 90%

The share of preferential programs in mortgage issuance in the primary housing market has exceeded 90%, that is, it now lives almost entirely at the expense of subsidies from the state, told "Izvestia" Director of the Department of Financial Policy of the Ministry of Finance Alexei Yakovlev. The ministry considers the level of 25% to be optimal. However, they do not plan to raise rates on state programs. In order to normalize the situation, it is now necessary to cool down lending in order to quickly create conditions for lowering the key rate, the ministry believes. According to experts, in early 2025 market mortgage rates will reach a maximum, but therefore will begin to decline.

How Russians take mortgages with a high key rate

Before the radical tightening of monetary policy (MP), the share of preferential programs in mortgage originations in the primary market was 80-85%.Now it has already exceeded 90%, Alexei Yakovlev, Director of the Financial Policy Department of the Ministry of Finance, told Izvestia.

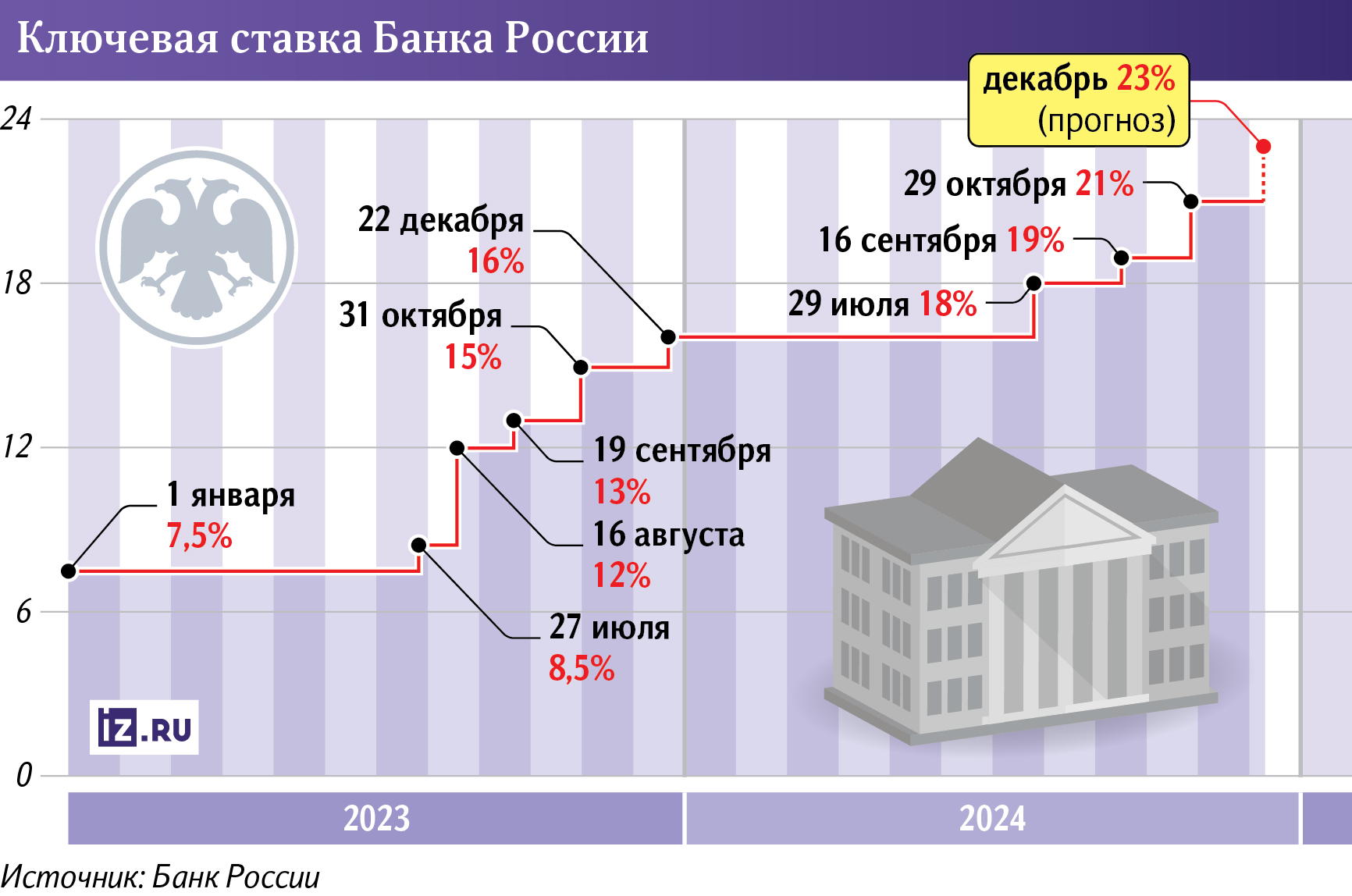

The Central Bank began to sharply raise the key summer back in the summer of 2023 - then it was at the level of 12%. And by October 2024, the Bank of Russia raised the rate to a record 21% to cool consumer demand and slow inflation.

The Ministry of Finance believes that the optimal share of preferential programs in the issuance of mortgages in the primary market - is 25%, said Alexei Yakovlev.

However, according to him, in order to reduce the share from the current 90%, rates on preferential programs are not planned to raise. Family mortgage is a social support measure. The Department will work within the parameters that have already been fixed, said Alexei Yakovlev.

Now there are several preferential programs in the market. The most popular is a family mortgage at 6%, it will be valid until 2030. Under this program, families with a child under six years old, a disabled child, as well as families with two minor children in small towns of up to 50 thousand people or in regions with a low level of construction can get a housing loan.

Far Eastern Mortgage provides a housing loan at 2% to customers up to 35 years old for real estate in the Far Eastern Federal District. There is also a special program for employees of accredited IT-companies. However, in the summer tightened the conditions for it: the rate increased to 6% and excluded from the program Moscow and St. Petersburg. Also, Russians can take out a loan under the program for rural residents at 3% for the purchase or construction of housing in a small community (no more than 30 thousand people).

As for increasing the attractiveness of market programs, now to normalize the situation, it is necessary to cool down lending to quickly create conditions for reducing the key, says Alexei Yakovlev.

The sooner it will be possible to contain inflation, the sooner it will be possible to reduce the rate, said Central Bank Chairman Elvira Nabiullina, speaking on December 4 at the forum "Russia Calling!". She added: by raising the key rate it was possible to prevent the emergence of inflationary spiral (it is a cyclical process in which rising prices generate a new increase in value).

However, inflation has not yet managed to cool down. By December 2, it accelerated to 8.3%, and by the end of the year may increase to 9%.

What conditions on mortgages are offered by banks

According to analysts "Domklik", in November, the share of preferential mortgage in the total volume of housing loans for new buildings amounted to about 95%, reported "Izvestia" in the press service of "Sber". In the Crimean RNKB this figure now exceeds 90%, confirmed in the press service of the credit organization.

- The share of preferential mortgages in issuance continued to grow, because market programs are frozen at current rates. They entail four to five times overpayment for the apartment at the usual down payment, - explained the managing director of the rating agency "Expert RA" Yuri Belikov.

Now banks offer to take a mortgage on market conditions at best at a rate of 25%, shared economist and expert on financial markets Olga Gogaladze. According to her, there are offers at 40%.

Therefore, even taking into account the fact that soft loans have become as targeted as possible, in the current conditions they remain the main driver of issuance, added Yuri Belikov. On July 1, the Russian Federation tightened the conditions for state programs. The authorities rolled back mortgages for new buildings at 8%, which had been operating since 2020.

Loans for housing on market terms are now taken by borrowers who already have a significant amount of money to buy an apartment and need only a small part on credit, said Marina Zabotina, deputy director of the department of business development of mortgages and premium segment of PSB.

When mortgage rates will be reduced

- Preferential mortgages have made the purchase of new buildings popular, because of which their prices have risen strongly in recent years. Now in some regions new apartments are 30-60% more expensive than housing on the secondary market, - said economist Olga Gogaladze.

According to her, when the share of preferential programs in the issuance is too large, it turns out that the market is supported artificially, and this makes the market dependent on subsidies.

To reduce the share of subsidized mortgages to 25%, it is necessary to gradually reduce the volume of state support and make loans without subsidies more affordable, the expert believes. And it is also worth supporting the secondary housing market, for example, through tax incentives. However, all this will be possible only when the key rate drops to 10-12% and inflation is under control.

Now the authorities will not tighten the conditions of preferential mortgages, because it may reduce demand for housing and cause dissatisfaction of people, says Olga Gogaladze. This will also affect developers: without preferential programs in the current conditions, they will face a drop in sales, which will lead to construction delays and an increase in the number of unfinished houses, she believes. To avoid the consequences, the Ministry of Construction has already proposed to introduce a moratorium on bankruptcy of developers until the end of 2025, Izvestia wrote.

This year there are still limits on family mortgage - 390 billion rubles out of 6.25 trillion, recalled the head of the Alternative Investment Management Directorate of MC "Alfa Capital" Vladimir Stolnikov. At the same time, in 2025 the limit was increased by another Br2.4 trillion compared to 2024.

Russians will start to make loans on market terms more often as the key interest rate decreases, VTB's press service said. However, given the Central Bank's signals, it expects rates to remain barrier-free for the whole of next year.

In the first half of 2025, mortgage interest rates may reach a maximum following further tightening of the CDA, said Marina Zabotina of PSB. However, in her opinion, a gradual decline is likely to begin in the second half of the year.

The Central Bank may lower the key rate to at least 8% in the next two years, believes Maxim Kolyadov, head of retail banking at AMsec24 Insurance Brokerage. This will allow citizens to take out loans under market conditions.

Переведено сервисом «Яндекс Переводчик»