Estimated spending: inflation to accelerate to 9% by year-end

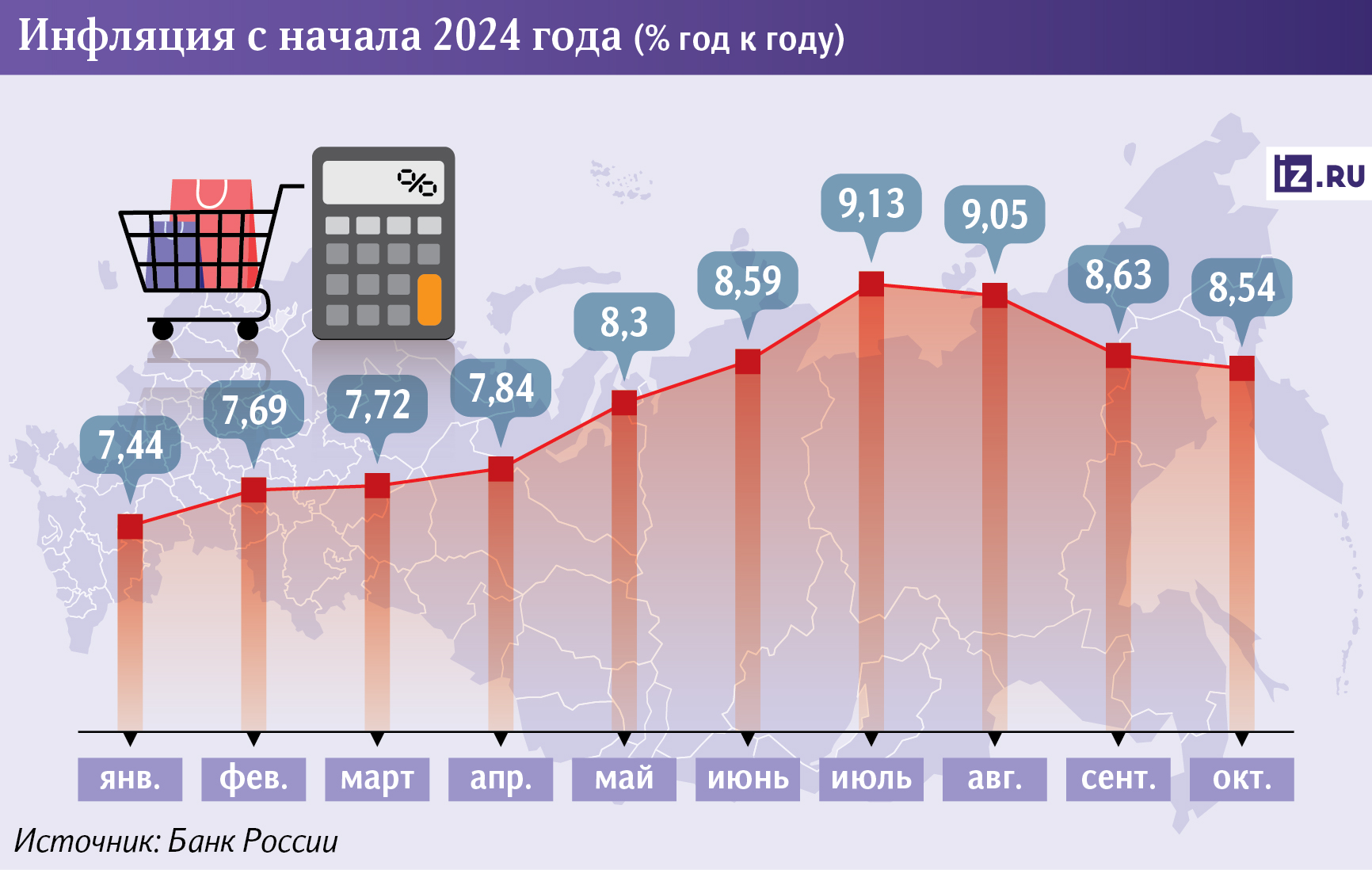

Inflation will rise to 9% by the end of 2024 instead of the 8-8.5% forecasted by the Bank of Russia, according to the Izvestia consensus forecast. This will happen due to the weakening of the ruble, which affects the cost of imports - both finished goods and raw materials, spare parts and materials. At the same time, the full-scale depreciation of the exchange rate will be reflected in prices only in two or three months, analysts warned. What else presses on inflation and what decision on this basis the Central Bank will take on the key rate - in the material "Izvestia".

How the ruble affects inflation in Russia

Inflation by the end of 2024 will be at the level of 9% per annum, according to five out of eight experts and market participants interviewed by Izvestia. Two more are sure that price growth will be between 8.5% and 9%. Only one of them named even more pessimistic figures - a range of 9-10%.

According to the November forecast of the Bank of Russia, inflation at the end of the year was expected to be 8-8.5%.

Analysts worsened their expectations due to the weakening of the ruble. In the last week of November, it weakened sharply against the dollar - the rate reached Br114 on the Forex market. However, then the Central Bank took measures, refusing to buy foreign currency to mirror the operations of the Ministry of Finance. Thanks to this, the ruble rolled back. On December 3, the Bank of Russia set the rate at Br107.2/$.

November 29, the head of the Ministry of Economic Development Maxim Reshetnikov emphasized that such fluctuations of the ruble are caused by one-time factors, including speculative factors.

- Our exporting companies continue to work steadily, imports are also recovering. Settlements under foreign trade contracts are underway. Adaptation to the next anti-Russian sanctions will be required, including in terms of changing banking mechanisms and channels of currency inflow to the Russian market," he emphasized.

The impact of the ruble exchange rate on inflation is due to several factors. Imported goods from other countries, as well as their components and parts, are becoming more expensive, explained Natalia Milchakova, a leading analyst at Freedom Finance Global.

In addition, currency depreciation contributes to the growth of inflationary expectations of the population and businesses. People will try to spend money on consumption faster, before prices for goods have increased even more, said Olga Belenkaya, head of macroeconomic analysis at Finam. As a result, manufacturers can afford to raise the cost of products in the moment.

- Prices on the domestic market of imported goods and services are determined by supply and demand. If the effective demand is not large enough, it will not be able to absorb imported goods at higher prices. In this case, the importer will have to sell the goods at the same price, and the ruble depreciation will lead to reduction of the importer's profit margin, - explained Dmitry Golubkov, Director for Macroeconomic Analysis of OTP Bank.

That is, if one day people do stop buying imported goods at inflated prices, then sellers will have to reduce the cost.

Why inflation remains high in Russia

The Central Bank itself estimates the impact on inflation of a 10% weakening of the ruble at 0.5-0.6 p.p., said Vladimir Evstifeev, head of the analytical department of Zenit Bank. He specified: now the effect may be several times stronger due to the uncertainty associated with the support of the national currency in the context of tightening external restrictions.

Moreover, it is unknown how long the rate will be kept near the maximum values, said Denis Popov, managing expert of the center of analytics and expertise of PSB.

However, inflation in Russia is affected not only by the depreciation of the ruble and rising import prices. Also among the factors is the shortage of personnel, which leads to an increase in the salaries of specialists to attract people to a certain area, emphasized Natalia Milchakova from Freedom Finance Global.

The exchange rate has been relatively stable throughout 2024, but inflation has been rising (in October it amounted to 8.5%), and the Central Bank was forced to raise the key rate to a record high of 21%. Other factors - foreign economic conditions (in particular, the price of oil), fiscal policy, structural factors (technological level of production, transportation infrastructure), factors on the supply side of goods and services - also influence the price increase, says Vladimir Lyubetsky, associate professor of the National Economy Department of the Presidential Academy.

In addition, the rise in prices was affected by the increase in fuel and transportation costs and the indexation of scrappage duty on foreign vehicles by 70-85% from October 1 (from January 1, 2025 will be indexed by another 10-20%), believes Olga Belenkaya of FG "Finam".

There is also an impact of crop losses in the spring of 2024 due to unfavorable weather conditions and the resumption of growth in world food prices, she added.

- The inflation rate in the first quarter of next year will remain quite high. This means that even with a slight decline in this period, it would be wrong to call the trend steadily downward, - said Denis Popov, managing expert of the center of analytics and expertise of PSB.

Weakening of the ruble in late November will lead to even more tightening of the Central Bank's monetary policy, says Natalia Milchakova. According to the analyst, the Board of Directors of the regulator at the meeting on December 20 will increase the key rate by 2 p.p. at once. - Up to 23% per annum.

However, this increase is likely to be the last in the current cycle, as the Bank of Russia and the government will have to find a balance between economic growth and the speed of inflation reduction to the target 4%, said portfolio manager of MC "Alfa Capital" Dmitry Skryabin.

However, so far the forecast of experts regarding inflation does not seem so optimistic: some expect a reduction in price growth only in the second half of 2025. But even in December next year, in their opinion, it will amount to 6-7%.

Переведено сервисом «Яндекс Переводчик»